41+ turbotax not deducting mortgage interest

See How Easy It Really Is Today. For example if you got an 800000 mortgage to buy a.

Video How To Figure Out Adjusted Gross Income Turbotax Tax Tips Videos

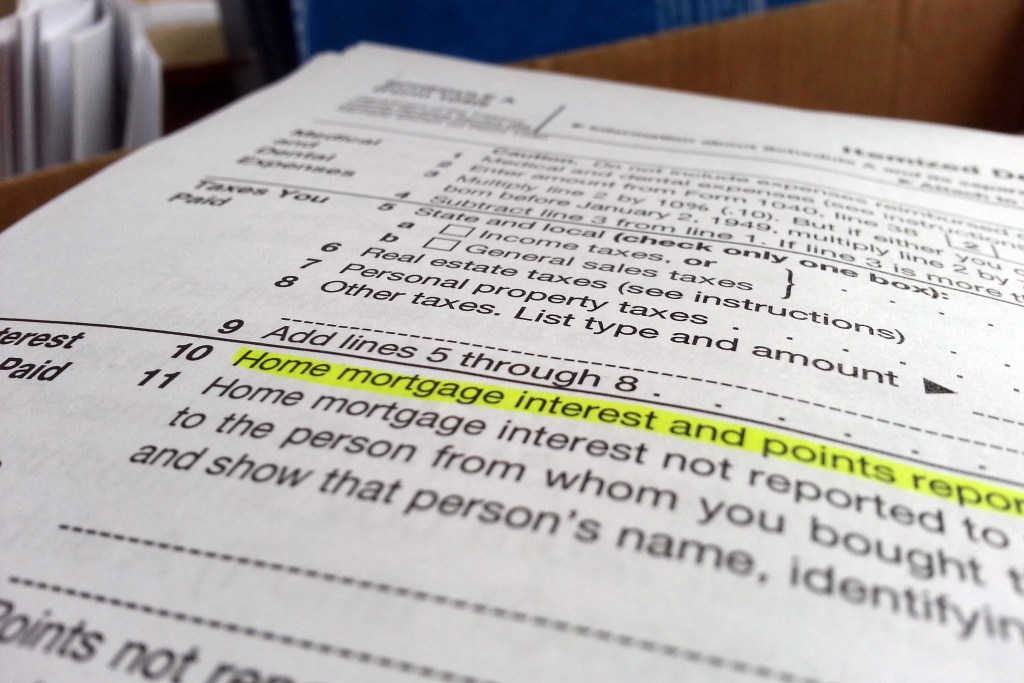

Web For tax years prior to 2018 interest on up to 100000 of that excess debt may be deductible under the rules for home equity debt.

. Web Due to the caps on mortgage interest deductions based on principal amount this could result in you unknowingly paying thousands of dollars more in taxes. Web TurboTax not deducting mortgage interest. Web 12 hours agoThe current average interest rate on a 30-year fixed-rate jumbo mortgage is 705 008 down from last week.

Web Up to 25 cash back If you purchased your home after December 15 2017 new limits imposed by the TCJA apply. Web 15 2017 you can deduct the interest you paid during the year on the first 750000 of the mortgage. Web The IRS places several limits on the amount of interest that you can deduct each year.

No Matter What Your Tax Situation Is TurboTax Has You Covered. The 30-year jumbo mortgage rate had a 52-week. I moved last year and boughtsold a house mid year.

Web 41 turbotax not deducting mortgage interest Sunday February 26 2023 As a result of the higher standard deduction itemizing. Also you can deduct the points. You may deduct the interest on only 750000 of home.

Two possible paths do not enter the HELOC information or it. Ad Tax Filing Is Fast And Simple With TurboTax. For tax years before 2018 the interest paid on up to 1 million of acquisition.

When I enter the mortgage interest for the first house everything looks fine. Web Yes the interest in the original first is allowed to be deducted as givenThe HELOC does not have this privilege.

Irs Mailing Letters To People Eligible For Stimulus Checks Money

How Are Dividends Taxed 2023 Dividend Tax Rates The Motley Fool

Turbotax Premier 2021 For Mac Does Not Correctly Compute Mortgage Interest Deduction From A Refinanced Mortgage

Mortgage Points Deduction Itemized Deductions Houselogic

Solved Turbotax Premier Not Deducting Mortgage Interest On Refinanced Mortgage

What Tax Breaks Do Homeowners Get In New York

How To Fill Out Irs Form 5695 To Claim The Solar Tax Credit

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

Mortgage Interest Tax Deduction What You Need To Know

Ira Required Minimum Distribution Not Satisfied Penalty And Penalty Waiver Request Wolters Kluwer

How To Find A Business Broker Who Will Really Think About How To Help Me And Not About His Own Profit Quora

Indian Americans What Not To Forget While Filing Us Taxes The Economic Times

These 13 Tax Breaks Can Save You Money Even If You File Last Minute Cnet

10 Strange But Legitimate Federal Tax Deductions Turbotax Tax Tips Videos

Deducting Mortgage Interest Faqs Turbotax Tax Tips Videos

Maple Ridge Times March 1 2011 By Glacier Community Publishing Issuu

How To Deduct Mortgage Points On Your Tax Return Turbotax Tax Tips Videos